Private Lending v. Real Estate Investing v. …

So you want to get into “investing.” What are the merits and pit falls of rental income properties? Or trust deed (i.e. private lending)? Or permanent life insurance, or apartment buildings or hotels or commercial or mixed use…

Do you feel exhausted yet? Or broke? Just going to seminars and trying to learn about all the different asset classes out there to invest in will drain your energy and your wallet. I’m sure you will learn some good tidbits along the way; after all, seminars is how we got into this business. However, we followed the bouncing ball a few times and then we had to force ourselves to be much more selective. We could have a very rousing discussion about the pros and cons of any or all investment strategies; but the one that I want to focus on in this moment is THE most important asset out there…

You.

Hopefully you aren’t thinking “oh man, this is one of THOSE posts, unsubscribe.” It is and it isn’t.

It is because I truly believe that the best investment that I make is the one I make in myself. The education, knowledge and experience I have is unquantifiable in it’s worth, usefulness and creativity. Just as you and your experiences are.

It isn’t because we are going to discuss how investing in your immediate financial landscape with just 10 minutes a week can pay big dividends. After all, you can’t help those around you if you can’t help yourself. Helping yourself centers around knowing where you are in life, in love, in business, in your family and in money. Money isn’t a bad word and it shouldn’t be one you shy away from. It is the fuel that moves your life and knowing, really knowing, the deep dark recesses of your financial world is what we are going to focus on right now. By knowing this about yourself, you will gain a greater understanding or knowledge than you could by going to any number of seminars.

We have been tracking just such a series of numbers for the last 897 days (as of this writing). That’s right, we have been tracking our weekly financial landscape for two weeks shy of 2.5 years. And let me tell you, the knowledge gained is staggering. Now we didn’t start out with such a project in mind, nor the wherewithal to even track everything that we really needed. This all evolved over time and as we got smarter and built up our business and understanding of the world of finance. Had we known then what we know now… Whew, it would be amazing! But the process and the learning along the way is what really was the most valuable part of our project.

This project started out as us wanting to know what debt metrics were. Where do those come from? Cash on hand and debt for the most part. There are a number of meaningful numbers to track, but we are focusing on these two for this discussion.

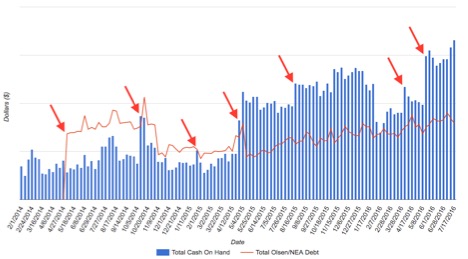

The chart below shows something simple, but very remarkable. The blue is the total cash on hand during a given week period. And the red line represents the corresponding debt in credit cards and lines of credit. The red arrows are significant events that happened in our financial life.

Each one of those red arrows I can go back and look at my notes and say “this is when we did…” <fill in the blank>. There is no question about what happened, only about the result that that action had. Let me give the quick and dirty result….

In 2.5 years we went from being relatively cash poor with a TON of credit card debt to being still in debt (fortunately or unfortunately depending on your perspective) but having nearly three times more cash on hand.

That, as our mentor would say, blows my mind.

It really does! I mean by doing nothing more than spending 10 minutes a week for 130 weeks (quick math => 22 hrs over 2.5 years) I have a track record of everything that we’ve done and can point to this or that and say it did or didn’t work and here is the result. How powerful is that? When I go into the bank or talk to our investors about going into a specific deal, I can come to them with confidence and know where I’m coming from.

Now many would say, well there are tons of apps out there to do this kind of thing for you. And you would be right. I’ve even used them myself! There’s one of the most popular one out there now, Mint.com which focuses on collecting all of your transactions and seeing if you can meet your budget each week or month. Also, ReadyforZero.com which collects your balances from your credit cards and bank accounts and helps you to pay down your debt faster, usually with adds. And then my favorite one, Automatic Wealth Building platform. We used this faithfully for nearly 2 years to help focus us and bring us closer to paying down our debt. I’m not endorsing or encouraging the use of these products for anyone, but they all serve a purpose.

While the tools listed above can be good beginnings, I found that none of them gave me the end result of what I needed to know about my financial landscape, which was how things are moving on a weekly basis. So, as they say, I scratched my own itch. I made what I needed to see and did the work of tracking the data until it was meaningful. And now I can’t see us NOT doing this because of the value it brings to our weekly family meetings. It is so powerful to be aware of this information and use it to catapult our finances forward.

By now you are thinking, he’s trying to sell me something or there is no light at the end of this tunnel. Well, on both counts you’d be wrong. I have made a lite version of this spreadsheet that anyone can use to get started. It doesn’t have all the features of tracking your debt metrics and many other useful things, but it does provide you the ability to track your own data and learn from it in real time. You will be able to track your cash to debt, like I’ve shown above, your debt to cash ratio, how your credit cards are helping (or hurting) your financial picture and even your debt to income ratio. You know, the one that nearly every bank out there wants to know before they will consider you for a loan?

Download this FREE tool to grow your wealth!

We are giving this tool away for free. We want to help elevate your personal financial landscape so that you can be a more knowledgeable and aware human, and, of course, a savvy investor. Just click the link below to get your download of this tool for use on your personal computer. I feel so strongly about the power of this knowledge that I want to give it to you to improve your finances and your life.

Download this FREE tool to grow your wealth!

As always, please don’t just read this and take it as gospel. Read it, think about it, discuss it with others and draw your own conclusions. Post your comments here so that others can benefit from your questions and insights!